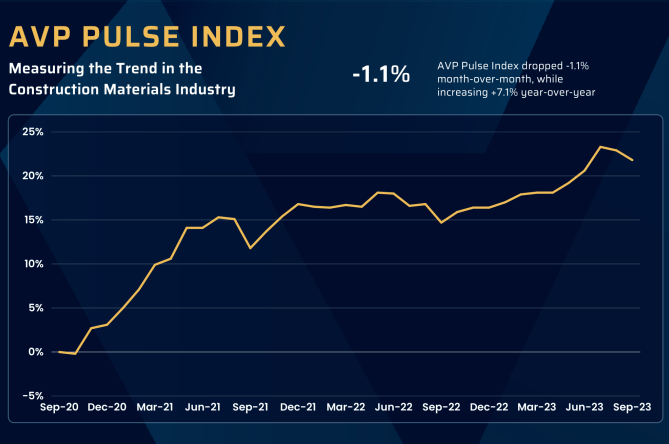

September 2023

Chart:

Summary:

The last quarter shows more of the same, and the construction trends continue to be steady with the AVP Pulse Index maintaining a very tight range. While the Index is down 1.1% from the prior quarter, it is still up a robust 7.1% year-over-year. A big driver of the movement last quarter was the run-up in Industry Stock Prices, which have all seen a pullback this quarter amidst the expected profit-taking after posting 52 -week highs. However, they are all still up a whopping 41.2% as a group, but the pullback has acted as a downdraft on our formula for calculating the Index.

A positive impact on the Index came from new housing market activity; Case Shiller was up 0.9%, and housing starts are still up 3.9% despite 7% mortgage rates that are weighing heavily on homebuyer demand.

But there are still some possible risks to the construction industry and its corresponding impact on construction aggregate demand. The current UAW strike is an unknown, and of course the concern that the Fed will over-tighten and stall the economy is still a possibility, but I am not betting on any of that happening.

To summarize the longer view, I’ll say again what I have said since the beginning of the interest rate hikes: no recession. I have not wavered from that view, and barring a “Black Swan” event that no-one currently sees coming, the economy will continue to remain steadily apace. And I’ll repeat what I said last quarter, because nothing has changed our outlook: when interest rates stabilize and cuts start taking place, it will be because inflation is tamed. I still think that is possibly as early as sometime next year, but regardless of timing, get ready for another broad economic expansion that will be a boon to construction aggregates.