Last month, I wrote about the steady (and heavy) hand that Jamie Dimon, JP Morgan Chase chairman and CEO, was bringing to the Return to Office movement with the opening of its sparkling new $3 billion headquarters at 270 Park Avenue in the best location in Midtown Manhattan.

But while the gleaming, 60-story symbol of banking success casts a long shadow over that part of the city, Dimon continues to spread the footprint of JP Morgan throughout the immediate Midtown neighborhood, assembling a chain of real estate assets in the area and creating a large urban campus. This New York City neighborhood is becoming a symbol of corporate banking power as Dimon purchases or leases vast swaths of the commercial properties surrounding his new headquarters building.

As has been widely reported in the business press, the other buildings in Dimon’s campus include the old Bear Stearns offices across the street at 383 Madison Avenue, which is about to get a $1 billion renovation. The Madison Avenue office served as JPMorgan’s temporary headquarters while 270 Park was going up (the bank tore down its old headquarters to build 270, taking advantage of the Midtown East rezoning to go bigger).

Then there’s 250 Park, which may become a hotel for colleagues, and all the other office space JPMorgan is leasing nearby, bringing the bank’s Midtown total to just under 6 million sq. ft., nearly as much as Goldman Sachs has in all of North and South America.

By Comparison. Amazon, which has been building its own Midtown East campus along the Bryant Park corridor, has just under 1 million sq. ft. All of this expansion reflects a newer trend, mostly available to the tech and financial behemoths, of assembling ad-hoc campuses that keep workers close together, as opposed to the far-flung Work-From-Home trend of just a few short years ago.

But Google is perhaps the first company to spread the Silicon Valley model to Manhattan, sprawling out from its Chelsea headquarters to Chelsea Market in 2018, then adding space at Pier 57 and, most recently, another 1.3 million sq. ft. at St. John’s Terminal in Hudson Square.

While companies are still renting less office space than they did before the pandemic, the old practice of downsizing in Manhattan and plunking employees in cheaper space in the hinterlands has fallen out of favor, and now a flashy new Manhattan headquarters is seen as a symbol of relevance and corporate muscle. By way of example, IBM, which decades ago decamped to a leafy suburban campus in Armonk, is now taking five floors in One Madison for a Manhattan flagship.

Perks and Amenities. 270 Park is next-level fancy, including coffee shops that learn employees’ order preferences, a food hall with 19 restaurants and desk-side delivery options, and an Irish pub that had specialty parts imported so it could serve a proper pint of Guinness.

There will also be an in-office wellness center where employees can go for “sick visits, acute care, general medical advice, lab work, allergy-shot management and international-travel preparation.” Windows that let in more light than typical office windows, indoor lighting timed to circadian rhythms and conference rooms with adjustable temperature controls are among the other wellness-oriented features. Also, a signature JPMorgan scent will be piped through the building.

There will be more along the theme of customization, including generative artwork that comes to life and moves when guests walk past, and even an indoor flagpole that will flutter in a direction corresponding to the wind outside, powered by a column of air that is determined by an anemometer measuring wind speed and direction on the top of one of the outdoor flagpoles.

This trend is a long way from the empty office spaces apparent everywhere by the end of the pandemic and further speaks to a future of new office development that will add to aggregate industry volumes.

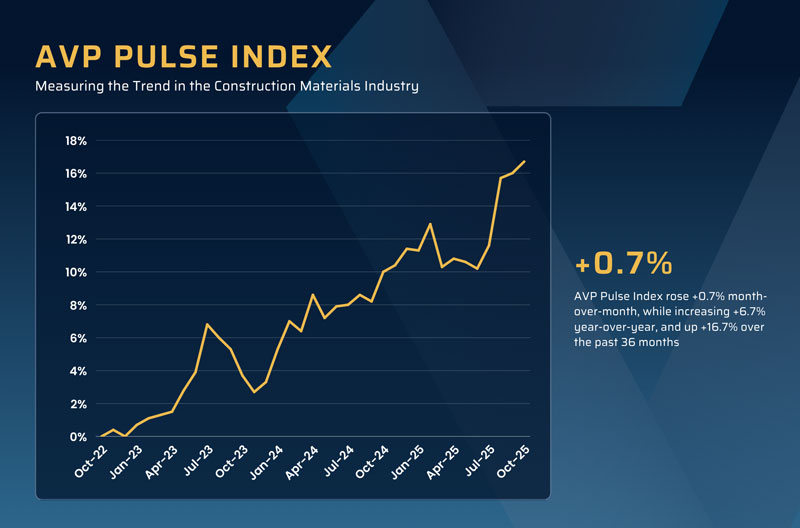

The AVP Index. This month’s pulse index is subject to error, as 4 of the 10 metrics we process through our algorithm are government-issued figures and are suspended due to the government shutdown.

Utilizing the remaining measures, we can estimate what an accurate Pulse Index would look like this month. The Index rose +0.7% month-over-month, +6.7% year-over-year, mirroring the last period’s similar performance. Additionally, it was up 16.7% over the past 36 months, likewise reflecting the gains in the last period, thus extending its steadily upward trajectory. In the absence of critical government-issued statistics, the Dodge Momentum Index (+3.4%), the Architectural Billings Index (+2.2%), and the Industry Stocks Average Price (+2.5%) all served to create a big lift for the Index. Hopefully we can get the government back to work, and next month’s Index should reflect the additional data supplied by the Federal Government, which will return the Index back to its pre-shutdown accuracy.

It is worth repeating that the AVP Pulse Index is a trend measure, like an arrow, albeit a crooked one; it measures a rolling 36-month period that points up or down depending on the direction of the construction industry. Despite the disruptions brought about by the tariff wars, we are optimistic this will come to an end, and we remain positive that prosperity in our industry lies ahead.

Pierre G. Villere serves as president and senior managing partner of Allen-Villere Partners, an investment banking firm with a national practice in the construction materials industry that specializes in mergers and acquisitions. He has a career spanning almost five decades, and volunteers his time to educate the industry as a regular columnist in publications and through presentations at numerous industry events. Contact Pierre via email at pvillere@allenvillere.com. Follow him on X @allenvillere.