One of my best friends for 40-plus years designs and installs custom closets. You’ve seen them – they usually integrate dressers, drawers and shelving with high- and low-hanging clothing racks to maximize floor space and assure that all walls are utilized to the greatest extent possible so we can stuff ever more pairs of shoes into them.

This category of discretionary consumer spending is considered to be in the top tier of the luxury goods business, because a single closet can cost many thousands of dollars.

So over the years, I have routinely asked him, “How is business?” I find the ups and downs of this non-traditional measure of our local economy to parallel what happens nationally and I consider it an important barometer in the way I view the pulse of the economy. Hearing him tell me about the swings in his business over all these years has convinced me it is a reliable barometer of the economy, as non-traditional as it might be.

Another Non-Traditional Metric. One that I find instructive serves as a preview of regular retail sales reports, which express how U.S. households are feeling about the economy: cardboard box sales. I’m talking about the corrugated cardboard used to make the boxes that transport everything from doughnuts to dishwashers. And most recently, the numbers are slumping, signaling that retail demand across industries may be due for its own correction in the not-too-distant future.

As has been published in the popular business press, U.S. box shipments, meaning volumes of empty packaging materials sold to retailers which in turn use them to ship orders to warehouses, storefronts and Americans’ doorsteps, fell to the lowest second quarter reading since 2015, according to data from the Fibre Box Association, a trade group. (Corrugated cardboard also goes into other items, such as 3D advertising displays, but since the vast majority is used for packaging, the industry tends to use “box shipments” and “corrugated cardboard shipments” interchangeably.)

International Paper Co., one of the world’s largest pulp and paper companies, reported a 5% drop in daily U.S. box shipments in the quarter from the same period a year ago, while packaging giant Smurfit Westrock Plc, based in Dublin, saw a 4.5% slide in North American corrugated cardboard volumes, the biggest drop across all of the regions it operates.

In a country where consumer spending makes up almost 70% of the economy, any retrenchment in retail activity tends to put economy watchers and government officials on alert. In June, U.S. retail sales rebounded after two down months, temporarily quelling anxiety about the health of the American consumer.

The strength of the highly seasonal cardboard box industry isn’t necessarily a one-to-one proxy for retail spending, but like beauty-shop outlays or consumer sentiment, it can flash early signals when things start to go amiss. And because boxes aren’t usually ordered that far in advance, they can offer a nearly real-time indicator of buying and manufacturing activity.

Mixed Messaging. Industry experts say most of the 2025 drop in packaging demand appears to be tied to President Trump’s mixed messaging on tariffs. Companies don’t yet know how the levies will affect costs and long-term demand for their finished products, and they’re not stocking up on bulky packaging while they wait to find out.

Couriers such as FedEx Corp. and United Parcel Service Inc. have opted not to give their usual update on full-year guidance with everything so up in the air. But UPS did recently tell analysts that the small-package market in the most recent quarter was unfavorably impacted by U.S. consumer sentiment that was near historic lows. The hope is that box demand will start to pick up this fall based upon the settling of the tariff situation, if that finally happens.

Indicators like custom closet sales aren’t published, but so many others are, like cardboard box sales. Approximately 70% of our economy is the average consumer, and as always happens, a pullback from spending will have a downdraft on sales of construction aggregates.

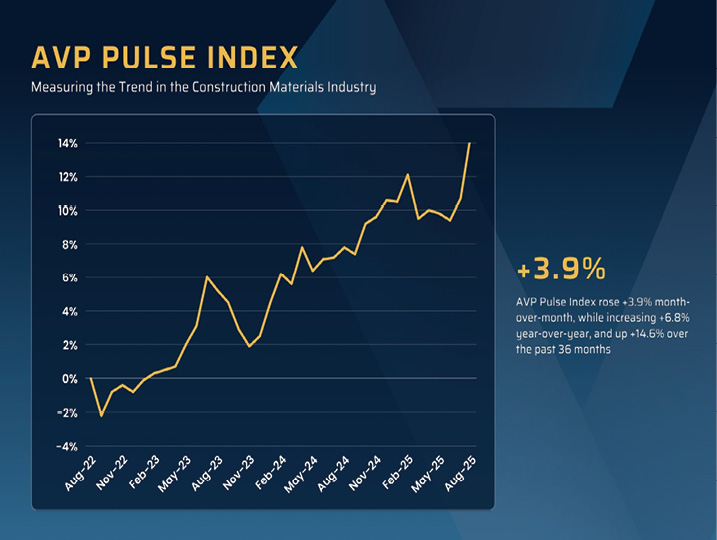

AVP Pulse Index. In a remarkably positive turn of events, the AVP Pulse Index took a giant leap upwards on the heels of last month’s small gain, which was still a turnaround from a previous string of losses. It jumped to one of the highest gains in a single month ever, up +3.9% month-over-month, therefore adding just shy of 5% in the last two months. The turnaround was driven in part by big jumps in the Dodge Data Momentum Index, up a whopping +20.8%, coupled with the strong performance of the Industry Stocks Average Price, which was up an equally eye-watering +20.1%. Those two metrics alone offset minor losses in other indices that were each less than -1%, therefore bolstering the Pulse Index.

It is worth repeating that the AVP Pulse Index is a trend measure, like an arrow, albeit a crooked one; it measures a rolling 36-month period that points up or down depending on the direction of the construction industry.