Construction Materials

- The Federal Reserve has maintained rates at 4.25% – 4.50% since the last 25 basis point cut in December 2024. It is uncertain as to when we will see the next rate cut. Futures markets are pricing in a quarter percentage point cut for the September meeting.

- The current annual inflation rate increased slightly to 2.9% in August from 2.7% in July. This marks the highest inflation rate since January.

- The continuation of inflated housing prices, the pace of the Fed’s rate cuts, and constantly evolving policy changes are all things to watch in the months ahead as they will have a significant impact on the overall economy.

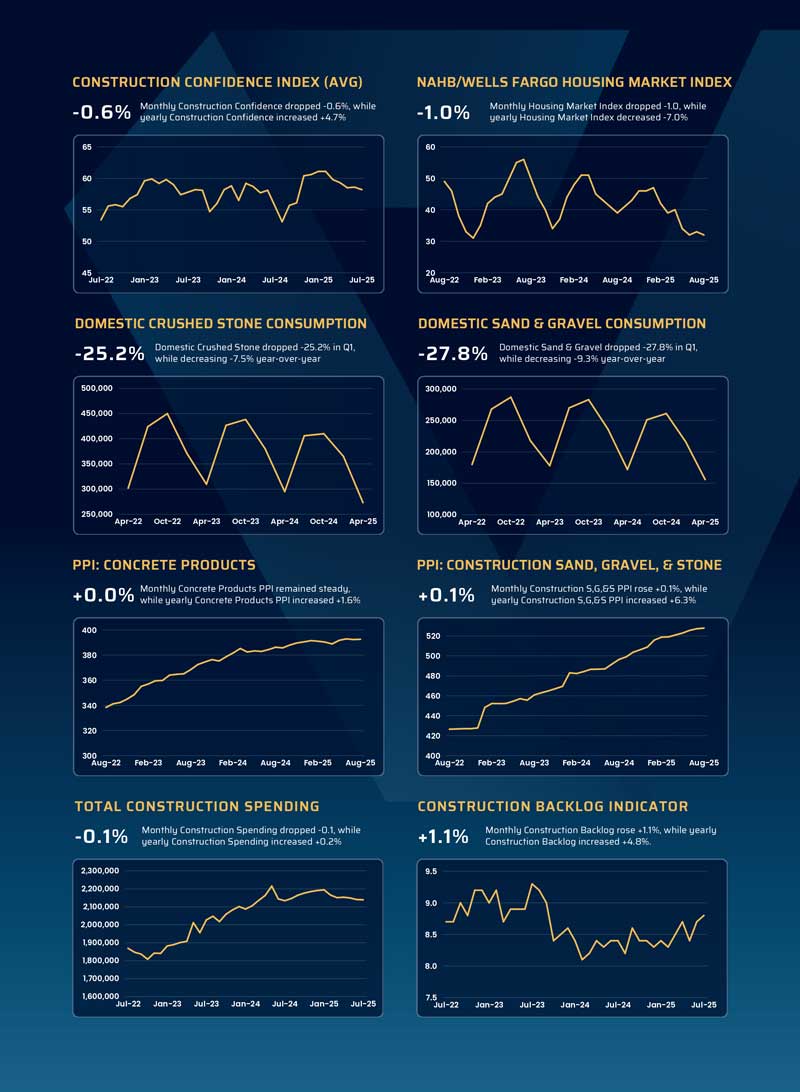

- The Conference Board Consumer Confidence Index fell to 97.4 in August. This is a 1.3 point drop from July’s 98.7 reading. The University of Michigan Index of Consumer Sentiment also saw a decrease for August with a reading of 58.2, down from 61.7 in July.

- As reported in August, the most recent cement shipment data shows a 7.5% decline in shipments in May 2025 compared to May 2024.

- The Infrastructure Investment and Jobs Act (IIJA) continues to provide a safety net for the Construction Materials industry. As of July 31, 2025, approximately 71% ($305B) of the available $431B budget had been locked in as committed funds.

Pierre Villere’s Market Assessment

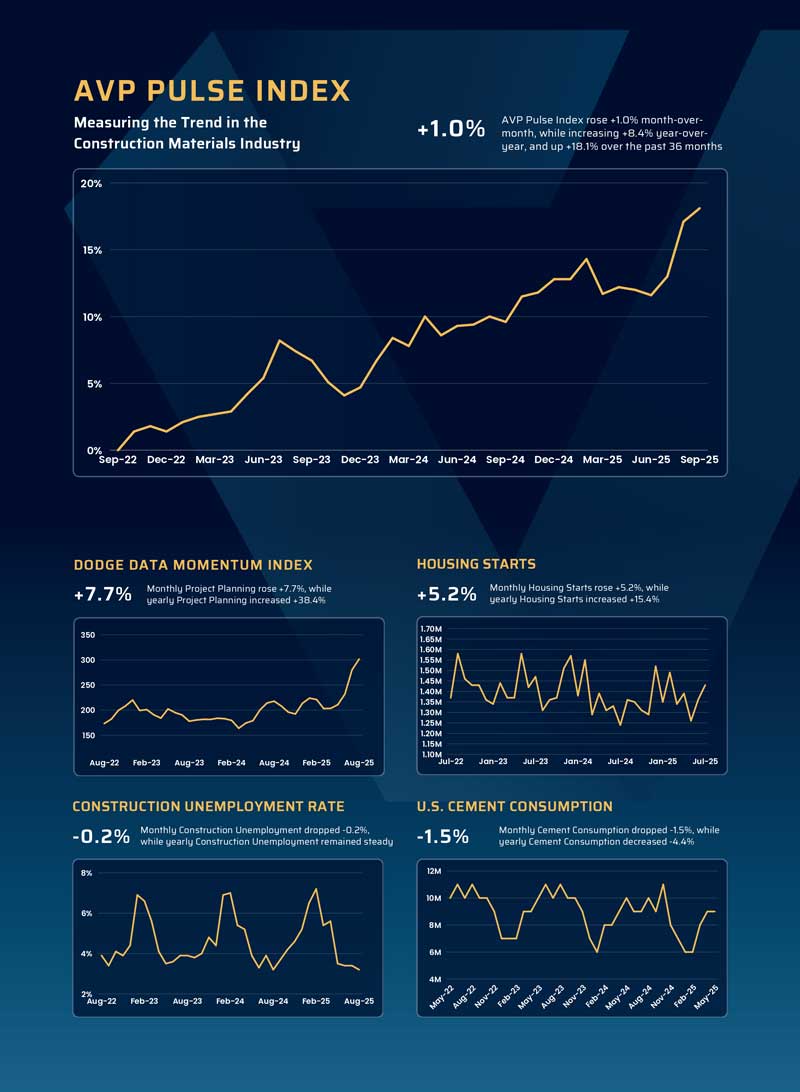

In a reversal, the Index took a strong upward move into positive territory last quarter, as ever so slightly falling mortgage rates have had the intended effect of moving buyers off the benches and back into the home buying fray, which will increase in the months ahead as rates continue their slow fall. The potent combination of stronger housing starts (+5.2%) and the Dodge Momentum Index (+7.7%) served to bolster the Index in the most recent quarter, despite the see-saw of consumer confidence, which has seen some of its greatest swings ever in calendar 2025.

Remember in the last quarter, the AVP Pulse Index was down 0.6% for the month, but still up +2.2% year-over-year and +8.2% over the past 36 months. As I said in both of the last two quarters, “… in a cautionary note, we do not expect the monthly results will change their downward drift for the foreseeable future, so expect the Index to continue to point downhill until we see changes in current policy.” Three months on since I wrote that, the pendulum has begun to swing back, as the Index is up +1.0% for the month, +8.4% year-over-year, and +18.1% over the past 36 months. The yearly measurement has almost quadrupled in the most recent quarter, and 36-month measurement metric is more than double the amount in the last quarter, indicating a strong resurgence due in part to the occasional upward swings in the Consumer Confidence and Sentiment Indexes.

My position hasn’t changed since my commentary last quarter: “given the uncertainty and chaos in the overall economy, I am asked more often now about my outlook for the construction economy, and I remain positive. Maybe the next several months will be difficult, but the chaos and uncertainty will come to an end, probably well before the mid-term elections which are little more than a year away. If I’m right, you see the headlights pointing uphill again as the industry gets past the current downdraft.”

It is worth repeating that the AVP Pulse Index is a trend measure, like an arrow, albeit a crooked one; it measures a rolling 36-month period that points up or down depending on the direction of the construction industry. Despite the recent disruptions, we are optimistic this will come to an end, and we remain positive that prosperity in our industry lies ahead.

About Allen-Villere Partners

Allen-Villere Partners (“AVP”) is the premier mergers & acquisition advisors and valuation services firm to the construction materials industry, focused exclusively on the ready-mixed concrete, construction aggregates, concrete products, and asphalt industries. For over 40 years, AVP has developed a special emphasis on representing the independently owned, middle-markets companies that play such a key role in the competitive landscape of construction materials. With over 60 years in combined experience and highly specialized, industry-specific skills, Allen-Villere Partners has a national reputation for excellence in its client representation.

Track Record

- Valued over 600 companies in this industry over the last 40 years

- Sold over 100 companies in the construction materials industry

- Client relationships in more than 44 states

- Completing deals in this healthy mergers & acquisitions environment