Calculating the Break-Even Point will help every concrete producer understand how much revenue the business needs to generate in order to be profitable.

Back in 2007, I wrote a similar column for this publication on one of the questions I am asked most often by clients, by attendees at industry conferences, and through email inquiries: “How do I know what my break-even point is?” It seems to be a timeless question of interest on the part of ready-mixed concrete producers, so I thought I would explain it here once again.

First, it is critical for all concrete producers to understand how the break-even point is calculated, as it is one of the most important indices in running a concrete business. And it is a simple equation: how many yards do I have to produce to break even? In a year when the industry is witnessing a robust recovery in pricing strength, if not in overall volume growth, it is a topic worth studying to assure every producer understands it.

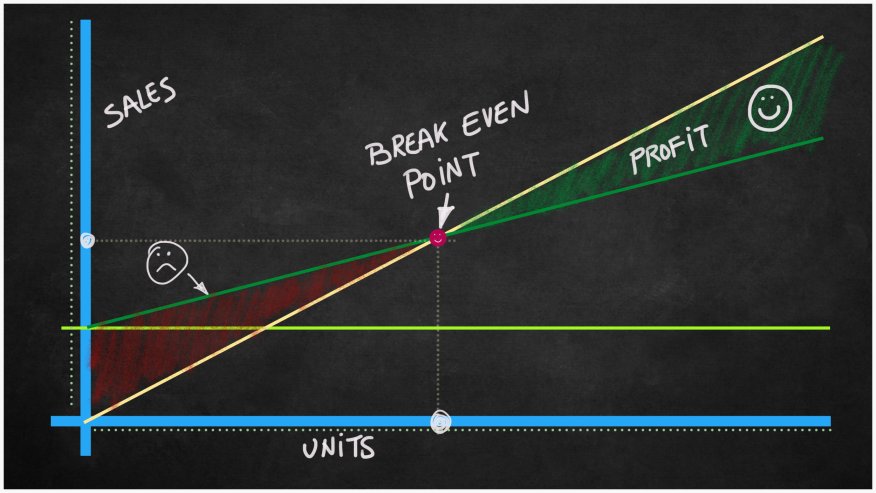

By definition, the Break-Even Point is the point where expenses or costs equal revenues. Quite simply, it is the inflection point when a concrete business neither makes money nor losses money. Calculating the company’s Break-Even Point allows a producer to understand the following key questions:

- Are fixed costs in line with the volume and revenue structure of my business?

- How many yards of ready-mixed concrete does my business need to sell to pay for its fixed costs?

- How much revenue does my business need to generate to pay for its fixed costs?

- When can my business bid projects more aggressively and still add profits to the bottom line?

To calculate the Break-Even Point in dollars, we use the following formula:

Total Fixed Costs ÷ (Gross Profit ÷ Revenue)

Gross Profit, also known as Marginal Contribution, is defined as “revenue minus all variable costs”. To calculate the Break-Even Point in cubic yards, just substitute cubic yards for revenue in the formula above.

In order to calculate the Break-Even Point correctly, we have to understand the difference between variable and fixed costs. Variable costs are defined as those costs that are directly associated with the production and delivery of concrete, such as raw materials costs, variable delivery costs and variable plants costs. Examples of variable delivery costs include driver’s wages and benefits, repairs and maintenance costs for mixer trucks (including parts, oil, mechanics wages and benefits), tires and fuel costs. Variable plant costs include wages and benefits for plant managers, batchmen and yard men, repair and maintenance costs for concrete plants and yard equipment (loaders, etc.), power costs (electric, gas, etc.) and waste concrete disposal.

Fixed costs are defined as all other delivery and plant costs that are not included in variable costs, as well as all selling, general, and administrative expenses. Some examples of fixed delivery costs include depreciation for concrete mixers, truck lease costs, salaries, wages and benefits for dispatch and order-taking personnel, and vehicle license, registration and insurance costs. Examples of fixed plant costs include plant and equipment depreciation, plant and equipment leases, quality control costs (including salaries and benefits), real estate taxes, environmental costs and information technology costs related to the batch plant.

If a business is not profitable in a given month or over a period of several months, calculating the monthly Break-Even Point can tell us how much more revenue is required to cover fixed costs each month; alternatively, it points to the need to examine the fixed costs structure if growing revenue is not a realistic option. But more importantly, if reducing the selling price is the only way to increase volume, this can be a drastic misstep, because the Break-Even calculation changes along with the reduction in gross profit.

Another way to utilize the Break-Even Point is to determine how aggressively a business can pursue new jobs. Since fixed costs are fixed, there comes a point during the fiscal year when enough revenue, and gross profit, has been generated to cover fixed costs for the remainder of the fiscal year. At that point, the gross profit from the sale of each additional cubic yard of concrete falls directly to the bottom line.

Calculating the Break-Even Point will help every concrete producer understand how much revenue the business needs to generate in order to be profitable, and can also be an important tool to guide the sales force in their pricing strategy throughout the fiscal year.

About the Author

Pierre G. Villere serves as president and senior managing partner of Allen-Villere Partners, an investment banking firm with a national practice in the construction materials industry that specializes in mergers & acquisitions. He has a career spanning almost five decades, and volunteers his time to educating the industry as a regular columnist in publications and through presentations at numerous industry events. Contact Pierre via email at pvillere@allenvillere.com. Follow him on Twitter – @allenvillere.